Interest rate swaps (IRSs) are often considered a series of FRAs but this view is technically incorrect due to differences in calculation methodologies in cash payments and this results in very small pricing differences.įRAs are not loans, and do not constitute agreements to loan any amount of money on an unsecured basis to another party at any pre-agreed rate. This adjustment is called futures convexity adjustment (FCA) and is usually expressed in basis points. The nature of each product has a distinctive gamma (convexity) profile resulting in rational, no arbitrage, pricing adjustments. Because STIR futures settle against the same index as a subset of FRAs, IMM FRAs, their pricing is related. Extended description įorward rate agreements (FRAs) are interconnected with short term interest rate futures (STIR futures). An FRA between two counterparties requires a fixed rate, notional amount, chosen interest rate index tenor and date to be completely specified. That index is commonly an interbank offered rate (-IBOR) of specific tenor in different currencies, for example LIBOR in USD, GBP, EURIBOR in EUR or STIBOR in SEK.

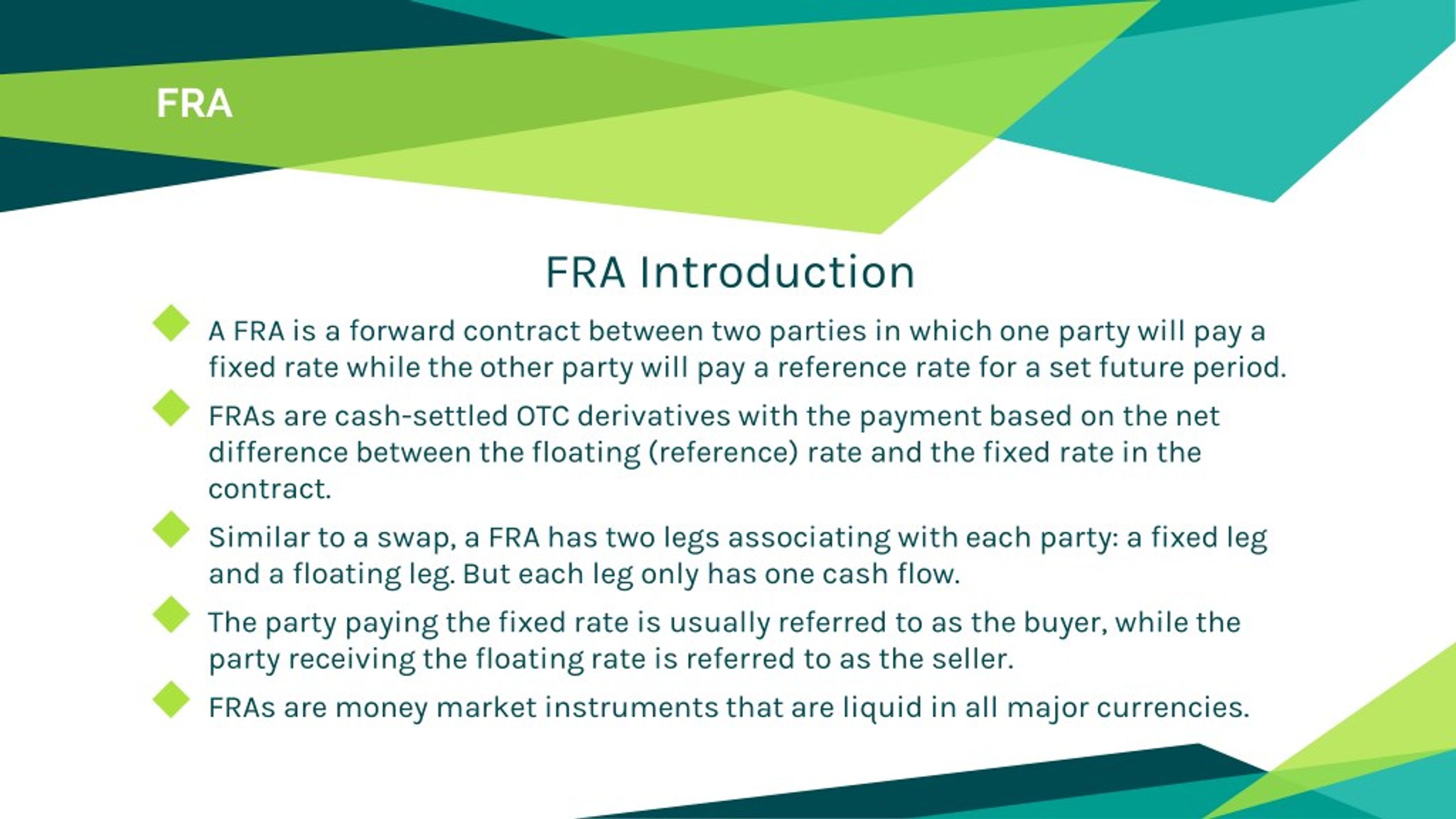

In particular it is a linear IRD with strong associations with interest rate swaps (IRSs).Ī forward rate agreement's (FRA's) effective description is a cash for difference derivative contract, between two parties, benchmarked against an interest rate index.

In finance, a forward rate agreement ( FRA) is an interest rate derivative (IRD).

0 kommentar(er)

0 kommentar(er)